The Future of

Investment Research

The Future of

Investment Research

AI-powered platform for investment banks, hedge funds and asset managers,

built to streamline investment research workflows with the first multi-agent system for finance.

AI-powered platform for hedge funds

and asset managers,

built to streamline investment research workflows

with intelligent automation.

Featured in

Global Coverage

Companies Covered

Countries Represented

Companies Covered

Countries Represented

Stock Exchanges Covered

Languages Supported

Languages Supported

Purpose built for investment professionals

LinqAlpha helps equity and investment research teams plan and execute faster workflows using automation.

From pulse check to primer, our AI agents reduce manual effort and deliver sharper investment insights.

LinqAlpha helps equity

and investment research teams plan

and execute faster workflows using automation.

From pulse check to primer,

our AI agents reduce manual effort

and deliver sharper investment insights.

LinqAlpha helps equity and investment research teams plan

and execute faster workflows using automation.

From pulse check to primer, our AI agents reduce manual effort

and deliver sharper investment insights.

Proprietary Data

Agentic Workflow

Data Integration

Proprietary Data

Comprehensive

Financial Data,

Curated by Experts

Comprehensive Finance Data, Curated by Domain Experts

Comprehensive Finance Data, Curated by Domain Experts

We structure filings, transcripts, and market data

to help analysts validate ideas and prepare initiation reports.

We combine public filings, transcripts, news,

and alternative data to deliver next-level insights for investment research.

We combine public filings, transcripts, news,

and alternative data to deliver next-level insights for investment research.

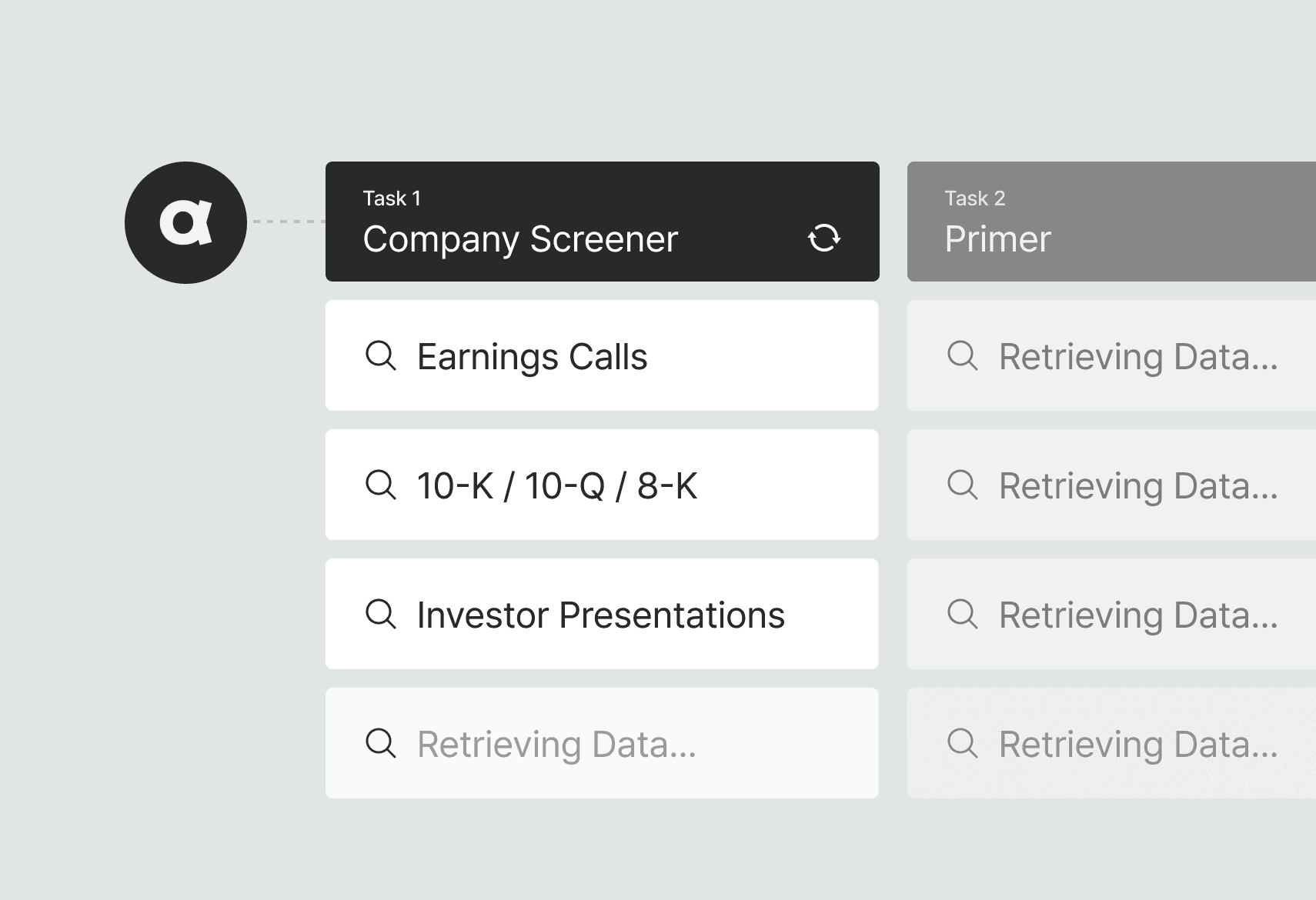

Agentic Workflow

Finance-specific Workflows designed

by Finance Professionals

Finance-specific Workflows designed

by Finance Professionals

Finance-specific Workflows designed

by Finance Professionals

Our multiagent system coordinates tasks like company screening, pulse checks,

and peer comparison.

Our multiagent system coordinates tasks like

company screening, pulse checks,

and peer comparison.

Our multiagent system coordinates tasks like

company screening, pulse checks, and peer comparison.

Hyper-Personalization

Seamless Data Integration for Tailored Insights

Seamless Data Integration for Tailored Insights

Seamless Data Integration

for Tailored Insights

Merge internal documents with external sources

for faster equity research.

Effortlessly merge proprietary datasets

with client-side private data for precision-driven decision-making.

Effortlessly merge proprietary datasets with client-side private data

for precision-driven decision-making.

LinqAlpha Empowers

Investment Research Teams with

Actionable Insights

LinqAlpha

Empowers Investment Research Teams with Actionable Insights

Testimonials

“It’s easy to use and outperforms any tool on

the market. It delivers precise analysis, cutting down time spent on repetitive tasks so I can focus on strategy."

“It’s easy to use and outperforms any tool on the market. It delivers precise analysis, cutting down time spent on repetitive tasks so I can focus on strategy."

Analyst

Fortune 50 Global Investment Bank

“LinqAlpha has significantly broadened my market research. The multilingual coverage is a game-changer, providing insights in local markets I wouldn’t have accessed otherwise.”

“LinqAlpha has significantly broadened my market research.

The multilingual coverage is a game-changer, providing insights in local markets I wouldn’t have accessed otherwise.”

“It’s easy to use and outperforms any tool on

the market. It delivers precise analysis, cutting down time spent on repetitive tasks so I can focus on strategy."

Investor

A Global Platform Fund

“LinqAlpha has significantly broadened my market research. The multilingual coverage is a game-changer, providing insights in local markets that wouldn’t have accessed otherwise.”

Investor

A Global Platform Fund

“It makes investment research faster and analyzing earnings calls effortless. Thanks to quick primers and sentiment quantification, I can cover SMID-cap names with confidence and speed.”

“It makes investment research faster and analyzing earnings calls effortless. Thanks to quick primers and sentiment quantification, I can cover SMID-cap names with confidence and speed.”

Investor

$300bn Global Long-Only Fund