Jacob Chanyeol Choi

Aug 28, 2024

Developing specialized embeddings to meet the unique demands of financial data analysis

Linq-Embed-Finance: Bridging the Last Mile of Accuracy in Search

Large Language Models (LLMs) have inherent limitations due to their restricted context token window, making it challenging to process thousands of documents effectively. To address this, Retrieval Augmented Generation (RAG) is used, retrieving relevant external data to supplement the model’s understanding. The effectiveness of RAG relies heavily on the performance of the embedding model.

At Linq, we began by addressing these challenges with Linq-Embed, which set a new standard in text retrieval. Now, we’ve built upon that success with our latest finance-specific embedding model, tailored to meet the specialized demands of financial data.

Why a Finance-Specific Model?

General-purpose models often struggle with the complexity of financial documents, which contain specialized jargon, intricate numerical data, and context-specific information. These models are not optimized for financial data, leading to suboptimal results in financial research.

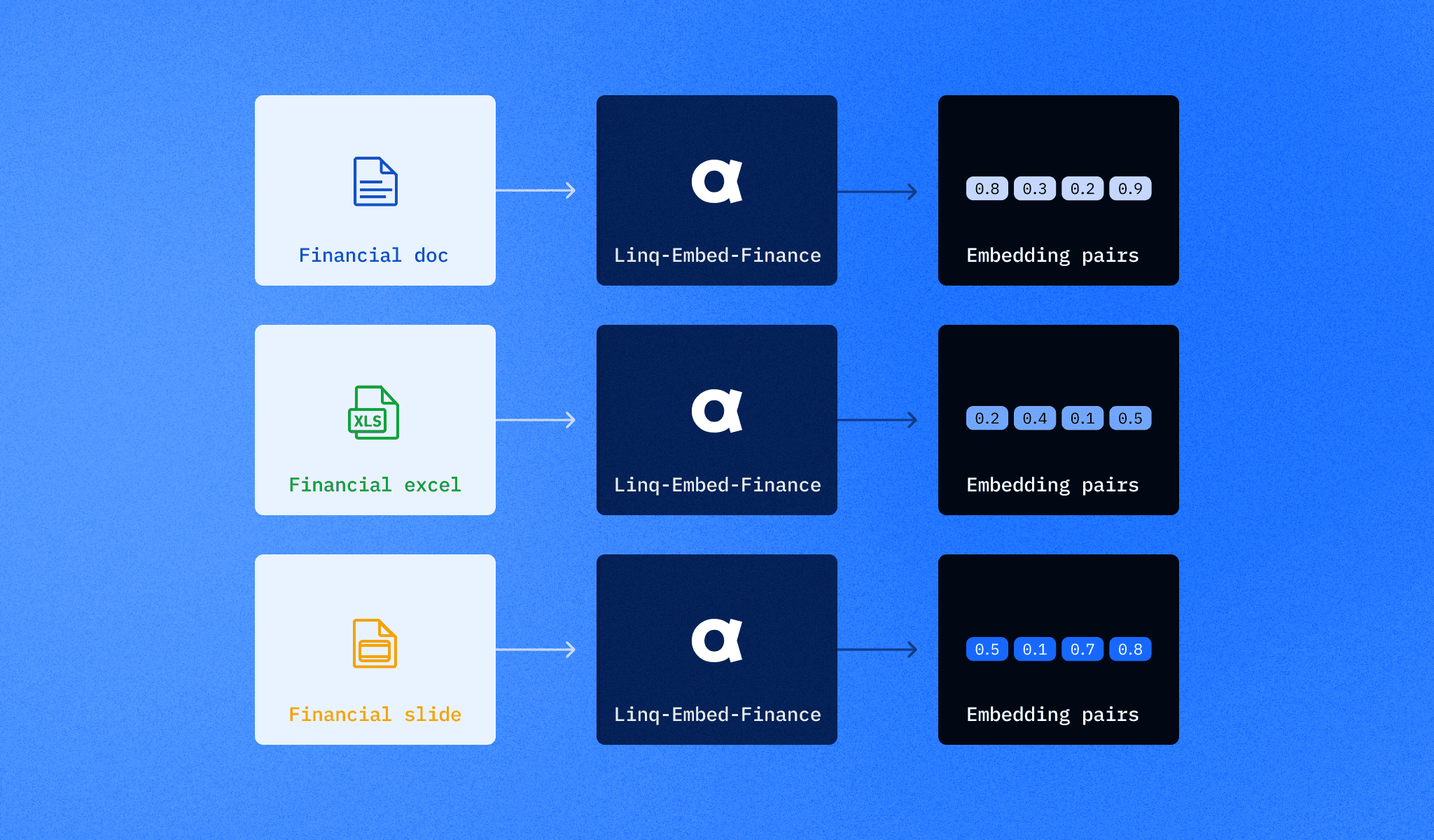

Financial analysts require precise, contextually accurate information, and our finance-specific embedding model, Linq-Embed-Finance, was developed to address these unique needs. The model ensures that analysts get the exact, relevant, and context-rich data they need to make informed decisions by:

Understanding Financial Terminology: Being trained on specialized financial jargon and industry-specific language for accurate retrieval.

Handling Complex and Numeric Data: Specializing in processing data formats like tables and figures, essential in financial analysis.

Optimizing Retrieval for Financial Documents: Ensuring precision across a wide array of financial sources, such as earnings reports, public filings, and financial statements.

Built with extensive use of financial data, the model’s embedding dimensions were fine-tuned to better capture the intricate relationships and subtleties within financial data. Advanced synthetic data generation and data refinement techniques—such as data crafting, filtering, and negative mining—enhanced the model's ability to filter out misleading documents and focus on task-specific data. These methods allowed the model to accurately capture the complex relationships within financial documents, greatly improving its performance.

Quantitative Evaluation: Focused on Finance

We evaluated Linq-Embed-Finance on a range of datasets representing real-world financial research tasks, including retrieving data from 10-K filings, answering questions over earnings reports, and handling multi-hop queries in annual reports.

FinQA | Earnings reports question-answering

ConvFinQA | Conversational queries over earnings reports

TATQA | Hybrid tabular and text queries over financial reports

MultiHeiTT | Multi-hop queries over annual reports

FinDER | Passage retrieval from 10-K reports

FinanceBench | Natural queries over public filings

FinQABench | Query-based retrieval from 10-K reports

Performance Comparison

Linq-Embed-Finance was benchmarked against competitors, including Voyage-Finance, and consistently outperformed them in terms of precision and retrieval accuracy across all datasets.

We compared the performance of Linq-Embed-Finance, a domain-specific model built specifically for financial data, with several general-purpose embedding models like Linq-Embed, OpenAI's text-embedding-3-large, and Cohere's embed-english-v3.0, which are designed for more generalized tasks. Additionally, Voyage Finance 2 is another domain-specific model focused on financial data.

In FinQA, Linq-Embed-Finance achieved a score of 55.9, surpassing Voyage Finance (54.2) and showing nearly double the performance of OpenAI (27.6).

In ConvFinQA, Linq-Embed-Finance scored 57.6, slightly outperforming Voyage Finance (56.9) and significantly surpassing OpenAI (34.7).

For table-based queries in TATQA, the model reached 56.2, demonstrating its ability to accurately process both textual and tabular data, compared to Voyage Finance (45.8) and OpenAI (35.7).

In complex multi-hop queries such as MultiHeirTT, Linq-Embed-Finance achieved a score of 17.4, compared to Voyage Finance (12.3) and OpenAI (3.6).

For general document retrieval tasks, Linq-Embed-Finance also excelled, scoring 62.8 in FinDER and 91.4 in FinQABench, highlighting its superior ability to handle large-scale financial data.

Linq-Embed-Finance demonstrated significant improvements, particularly in multi-step queries and financial document searches, consistently showing 20-30% performance gains in precision and accuracy over general-purpose models. This is especially noticeable in tasks requiring the retrieval of highly specific financial information from vast datasets, like earnings reports spanning multiple fiscal years.

Conclusion: Search Tailored for Large-Scale Financial Data

Linq-Embed-Finance enables analysts to perform accurate searches across vast amounts of financial data. Whether dealing with earnings reports spanning multiple fiscal years or complex filings from hundreds of companies, RAG ensures that the most relevant information is retrieved, allowing for deeper insights that general-purpose models miss.

In our next post, we’ll explore how Linq Alpha’s Three Guardrails—trusted data, evaluation agents, and interactive validation—work together to ensure AI-generated outputs are not only accurate but also actionable and trustworthy.

👉 To experience how Linq’s tailored search solutions can enhance your financial research, please join our waitlist.